The Wealth Tax is a tax imposed on individuals whose total assets (including real estate, stocks, cash, etc.) exceed a certain amount. The purpose of this tax is to reduce wealth inequality and increase investment in social welfare and public resources.

―

Q: What is the Wealth Tax?

―

A: The Wealth Tax is a tax levied on individuals with a certain amount of wealth, calculated based on their total assets (such as real estate, stocks, cash, etc.).

This tax is paid based on the assets held, rather than income, aiming to reduce wealth inequality and enhance investment in social and public resources.

● How the Wealth Tax Works

Wealth Tax is typically imposed as a certain percentage of the annual asset value.

For example, if the Wealth Tax rate in Country A is 1%, a citizen of Country A with assets over 100 million won must pay 1% of their asset value as tax. This tax is primarily levied on high-income earners and wealthy individuals, promoting the redistribution of wealth in society.

―

Q: Why is the Wealth Tax Gaining Attention?

―

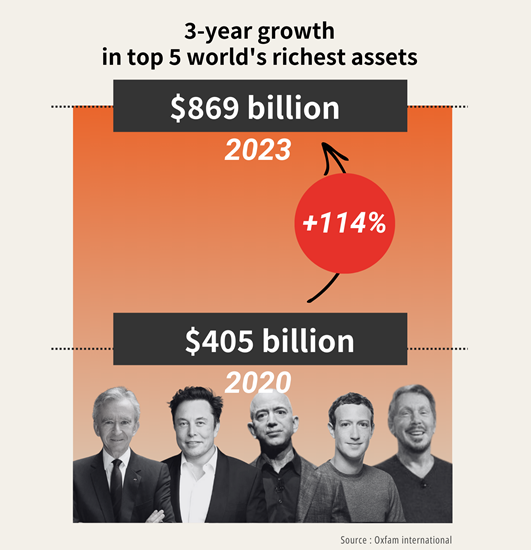

(Source: Oxfam International)

A: The increasing global wealth inequality has heightened interest in the Wealth Tax. Economic inequality can lead to social unrest and be a hindrance to economic growth. As a result, many countries are considering introducing or strengthening Wealth Tax.

● Intensifying Global Wealth Inequality: The Rise of Billionaires' Wealth

In recent years, the wealth of billionaires worldwide has significantly increased. For example, Jeff Bezos, the founder of Amazon in the United States, saw his wealth increase by nearly 75 billion dollars during the 2020 COVID-19 pandemic, reaching about 190 billion dollars.

On the other hand, the income of ordinary households has either stagnated or decreased. This extreme wealth disparity can create social unrest and hinder economic growth.

If you're curious about global inequality, check out the following article! ↓↓↓ |

● Addressing Social Inequality and Strengthening Public Services: Efforts to Improve Education and Health Services

The introduction of a Wealth Tax plays a crucial role in increasing investment in public services and social infrastructure.

Norway has successfully used the Wealth Tax to enhance its education and health services. The Norwegian government reinvests about 2 billion Norwegian kroner (approximately 230 million dollars) annually in public services from Wealth Tax revenue.

Thanks to this, Norwegian schools have acquired world-class educational infrastructure, and the public healthcare system has been further strengthened.

―

Do Billionaires Want a Wealth Tax?!

―

"The current tax system is unfair. Let us pay more taxes."

During the World Economic Forum in January 2022, over 102 super-rich individuals from 12 countries made headlines by sending an open letter stating, "Now is the time to solve the problem of extreme wealth inequality," and requesting, "Let us pay more taxes."

These individuals are members of the progressive wealthy group 'Patriotic Millionaires.'

Signatories include actor Mark Ruffalo, known for playing Hulk in the 'Avengers' series; Abigail Disney, heiress of Disney; American venture capitalist Nick Hanauer; and British entrepreneur Gemma McGough, among others.

The title of the open letter was 'In Tax We Trust.' Through the letter, they expressed, "We know the current tax system is not fair. Our wealth increased while the world suffered greatly during the COVID-19 pandemic. Almost none of us can say that we have paid our fair share of taxes." They stand for the idea that paying more taxes is fairer.

Nick Hanauer suggested that imposing a Wealth Tax on individuals with assets over 5 million dollars (about 6 billion won) could generate more than 2.53 trillion dollars (about 3000 trillion won) annually in tax revenue.

He pointed out that with such tax revenue, 2.3 billion people globally could escape poverty, vaccines could be sufficiently supplied, and 3.6 billion citizens in low-income countries could be provided with universal health care.

In January 2022, members of the progressive wealthy group 'Patriotic Millionaires' suggested improving the unfair tax system through an open letter titled 'In Tax We Trust.'

If you're curious about global inequality, check out the following article! ↓↓↓ |

―

Which Countries Implement a Wealth Tax?

―

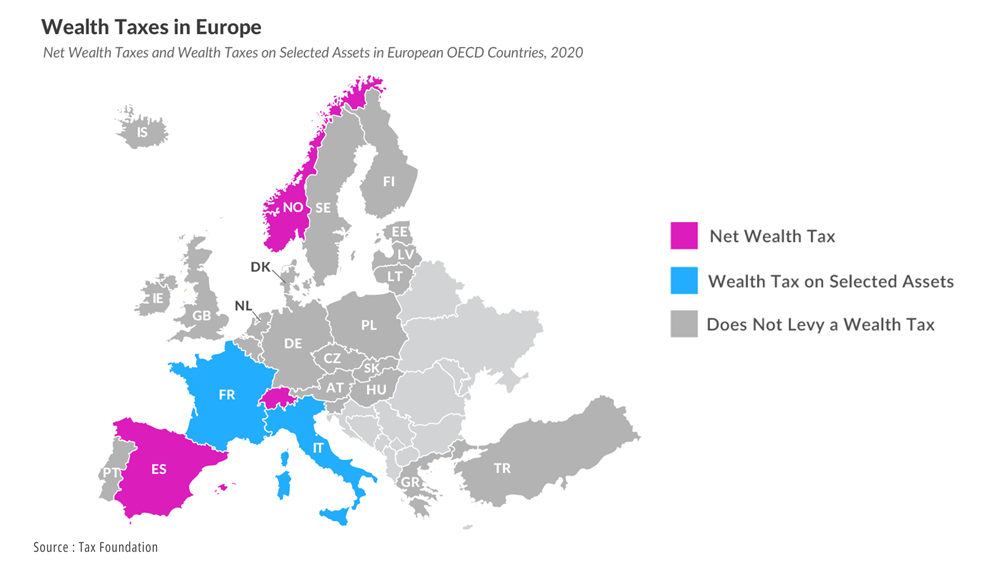

According to a report by the Tax Foundation, as of 2020, among the OECD countries, Colombia, France, Norway, Spain, and Switzerland impose various forms of Wealth Tax on individuals' net assets. In these countries, the revenue from the Wealth Tax accounted for about 1.5% of the total tax revenue, with Switzerland notably reaching 5.12%.

● Switzerland

In Switzerland, the Wealth Tax rate varies by canton. For example, in Zurich, a maximum Wealth Tax of 0.3% is levied on assets exceeding about 5 million Swiss francs (approximately 5.4 million dollars). Switzerland's high level of cantonal autonomy leads to varied applications of Wealth Tax rates.

● Norway

In Norway, individuals whose net assets exceed about 160 million Norwegian kroner (approximately 1.7 million dollars) must pay Wealth Tax. The rates range from about 0.7% to 1.5%, and many people are subject to this tax.

● France

France transformed its traditional Wealth Tax into a real estate Wealth Tax in 2018. Currently, in France, real estate assets exceeding 1.3 million euros (about 1.4 million dollars) are taxed at a rate of up to 1.5%.

● Others

Recently, the United States has been pushing for the introduction of a Wealth Tax known as the 'Billionaire Tax.' In March 2022, U.S. President Joe Biden proposed a minimum tax rate of 20% on unrealized capital gains for billionaires with assets over 100 million dollars (about 130 billion won), and in March 2023, he reiterated his intent to push for a minimum tax rate of 25%.

―

The Effects of the Wealth Tax

―

● Positive Effects of a Wealth Tax

▪ Promotion of Redistribution: In countries like France, Wealth Tax generates significant tax revenue, collecting about 3 billion euros annually. This funding is used in areas such as public services, education, and health, contributing to social equality.

▪ Reduction of Economic Inequality: Before the introduction of a Wealth Tax in Sweden, the top 1% owned about 25% of the total wealth. However, this ratio significantly decreased after its implementation.

According to the Oxfam report 'Survival of the Richest' published in January 2023, the income of the world's top 1% wealthiest people mainly comes from asset earnings, which are typically taxed at a lower rate compared to labor income, exacerbating the rich-get-richer phenomenon. The report argues that Wealth Tax can play an important role in economic development and expanding access to public services.

● Negative Effects of the Wealth Tax

▪ Capital Flight: In some cases, the introduction of a Wealth Tax has led to capital outflow to foreign countries. Sweden, the originator of Wealth Tax, abolished it in 2007 due to the steep incidence of wealthy individuals moving their assets abroad to avoid taxes.

▪ Administrative Complexity: The administrative cost of imposing and managing a Wealth Tax can be high, sometimes resulting in less tax revenue than expected.

―

Toward a Better Future

―

The Oxfam International report 'Survival of the Richest' highlights that the current concentration of wealth among a few is unsustainable and a hindrance to creating a more equitable world.

The Wealth Tax can play a crucial role in reducing wealth inequality, stabilizing society, and expanding inclusiveness, thereby safeguarding the values and practices of democracy.

However, this policy, while powerful, also faces several challenges. The key is to find a balanced approach that maximizes its benefits while minimizing its drawbacks.

What are your thoughts? How about contemplating together among our local group, whether such changes can positively impact resolving global inequality in our times?

“To embrace the future,

we must expand the scope of vocations that can herald the coming of peace.

Even though we may never meet our descendants, we must make sure that all their activities will harmonize in peaceful societies and nations.”

-Dr. Hak Ja Han Moon

Founder of Sunhak Peace Prize-

Learn More: Disaster drives inequality, inequality prevents peace |

References |

Written by Sharon Choi

Director of Planning

Sunhak Peace Prize Secretariat